In 2022 the Johns Creek City Council adopted a final millage rate of 3.986 which represented a preservation of the millage rate set in 2021. Before setting the 2023 millage rate, Georgia law requires a public hearing to be held to allow the public an opportunity to provide comment on the subject.

The City has scheduled three Public Hearings on the proposed 2023 millage rate and all residents are invited to attend and participate. The first will be held on July 25, 2023 at 6:00 p.m. in the City Council Chambers. A second Public Hearing will be held on August 8, 2023 at 11:00 a.m. in the Ocee Conference Room.

The third Public Hearing will be held prior to the anticipated adoption of the final millage rate for 2023 during the regularly scheduled City Council Meeting at 7 p.m. on Aug. 8, 2023. All Public Hearings will take place at 11360 Lakefield Drive in Johns Creek, GA 30097.

Each year, the Board of Tax Assessors is required to review the assessed value of taxable property in the county. When the trends of prices on properties that have recently sold in the county indicate there has been an increase in the fair market value of any specific property, the Board of Tax Assessors is required by law to re-determine the value of such property and adjust the assessment. This is called a reassessment.

For additional information on the proposed 2023 millage rate please visit the city website.

NOTICE OF PROPERTY TAX INCREASE

The City of Johns Creek has tentatively adopted a millage rate, which will require an increase in property taxes by 9.33%. All concerned citizens are invited to the Public Hearing on this tax increase to be held at the Johns Creek City Hall, Council Chambers located at 11360 Lakefield Drive, Johns Creek, Georgia on July 25, 2023 at 6:00 p.m. An additional Public Hearing on this proposed tax increase will be held at the Johns Creek City Hall, Ocee Conference Room on August 8, 2023 at 11:00 a.m. and 7:00 p.m. in the Johns Creek City Hall, Council Chambers.

Residents are invited to e-mail comments to public.comment@johnscreekga.gov.

This tentative increase will retain the current millage rate of 3.986, an increase of 0.340 mills above the rollback rate. Without this tentative tax increase, the millage rate would be no more than 3.646 mills (the rollback rate). The proposed annual increase for a home with a fair market value of $525,000 is approximately $67 and the proposed annual increase for a non-homestead property would be $71.

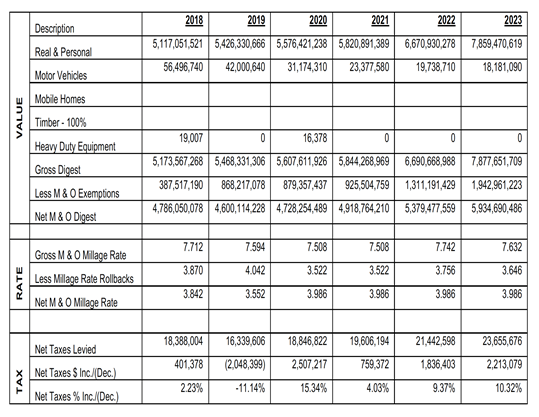

Pursuant to the requirements of O.C.G.A. § 48-5-32, the City does hereby publish the following presentation of the current year’s tax digest and levy, along with the history of the tax digest and levy for the past five years.